Additive Fabrication Transforms Dental Labs

Most rapid prototyping technologies are described in terms of their potential to change the world. Dental RP already has. You might not know it, but your recent crown or bridge may have been built layer-by-layer using additive fabrication.

Within three months this Spring, system manufacturers 3D Systems, envisionTEC, and Solidscape all announced the introduction of new machines that are dedicated to the rapidly-growing digital dental industry. Other companies like Ex One (imagen), EOS, and Materialise are already heavily invested in the market.

Wax-Ups Built by the

The dental industry is ideally suited for additive fabrication. There is a high volume requirement for precision individualized dental implants that have traditionally been laboriously fabricated by high-skilled technicians. Just the U.S. market for dental prosthetics is estimated at US$8.8 billion per year, according to iData Research.

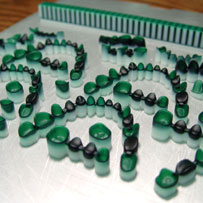

ProJet DP 3000

Photo courtesy 3D Systems

Traditionally, a dentist would take an oral impression and send it to a dental laboratory, where a technician creates a plaster model and hand-carves a wax-up (a wax mold of how the repaired teeth will look), investment casts it (using the lost wax technique), and adds a porcelain or ceramic veneer.

Today, a dentist can take an intra-oral digital scan of the mouth, transmit the data over the internet to the lab, where a technician uses a specialized CAD program to design the prosthesis. This file is outputted in STL format, imported into the RP machine, which automatically builds the wax-up or, better yet, the new tooth itself, which just requires the final porcelain cover.

The high tech alternative is to replace the rapid prototyping machine with a computer aided machining (CAM) approach. For example, Sirona Dental offers the CEREC method of fabricating restorations by using a CNC milling machine to mill the restoration from a solid ingot of ceramic. Alternatively, the pre-veneered alloy can be milled as well.

One of the primary advantages of the additive fabrication approach is reduced consumption of precious noble and high noble alloys, like gold, platinum, and palladium. The cost of these metals have risen about 40 percent over the last year, and stand at about US$900 per ounce for gold, US$2,000 per ounce for platinum, and US$400 per ounce for palladium. With CAM, much of this material ends up as chips on the floor. Also, certain alloys, like cobalt chrome, are difficult to machine, and the high level of detail means long mill times.

RP in the mass customization business of dentistry is here to stay. For the production of copings, crowns, bridges, and PFMs (porcelain fused to metal crowns), rapid manufacturing offers better consistency and fit relative to traditional methods, faster throughput, reduced skilled labor, and more efficient use of materials. One day it will be used to produce full ceramic restorations, including zirconia, that will have variable color built throughout the material due to selective coloring during the layering process.

Following is a look at offerings of some of the major players in the dental additive fabrication business. Although there are a lot of impressive new offerings in dental digitizing (scanning) and implant design software (most of which are “open architecture”, or third party compatible, products), we will not be covering them here.

3D Systems

Location: South Carolina, USA

Product: ProJet DP 3000

Launch: February 2008

Cost: US$80,000, including installation and training; US$119,000 including 3rd party scanner and software

Capability: Builds wax-ups, which can be cast or pressed with conventional techniques. Generates hundreds of units each cycle. Typical accuracy is .64mm-1.27mm per 25mm of part dimension.

Technology: Mulit-jet modeling, an inkjet technology that uses an acrylic-based build material and a wax support material

Adoption: High rate of dental adoption of the ProJet and other systems. Used by 3M ESPE Lava Labs, Cynovad, Sirona Dental, and Align Technologies for its Invisalign products.

From the Company: “3D Systems sees this as a potential high growth market for our machines,” says Buddy Byrum, director of global marketing. “We’re beginning to place systems in Asia.” At the 3D Systems investor meeting at the 2008 RAPID show in Orlando, 22 of the 67 powerpoint slides were dental related.

What’s Next: Working on a direct-to-metal printing process. Entered into an agreement in February 2008 to begin offering MCP Tooling Technologies’ selective laser melting (SLM) systems, but in May 2008 EOS filed a patent infringement lawsuit against MCP, saying that MCP is not authorized to sell its Realizer product line in North America.

Solidscape (formerly Sanders Prototype)

Location: New Hampshire, USA

Product: T76 System

Launch: April 2008

Cost: US$45,650

Capability: Builds wax-ups in a 232mm-squared build area. XY resolution is 5,000 dpi; build layers can be as fine as .013mm.

Technology: Vector-based single-droplet ink jetting. Slow, but has very high accuracy and resolution.

Adoption: Dental applications are relatively new for Solidscape, which has specialized for 10 years in jewelry, with 3,000 units now operating worldwide.

From the Company: “We’ve been selling systems to dentists for years, but it’s always been ‘Wow, look, a dentist bought one,’” says David Olson, director of business development. Traditionally, both industries have relied on skilled technicians to hand carve wax models, but “in general, dental does not need the accuracy of the jewelry market,” he says.

What’s Next: Develop additional dealer channels to market to this industry.

envisionTEC

Location: Germany

Product: Desktop DDP (digital dental printer), Mini DDP, and High Production DDP

Launch: March 2008

Cost: US$43,650, US$65,900, and US$85,900, including one-year maintenance and warranty

Capability: Simultaneously produces the lower simple coping and the upper anatomical crown in wax. Coping is automatically built with a sprue for direct investment casting. The largest system can produce up to 65 wax copings in less than two hours at a 35 micron resolution.

Technology: Voxelization process cures each individual voxel at a depth controlled by the light intensity of each pixel. Build time is independent from the number of models to be built.

Adoption: “I can’t keep them in stock,” says Stan Maragos, business unit leader for Zahn Dental, the high tech division of Henry Schein. Maragos says Zahn sells 10-15 per month, with the High Production DDP being the most popular.

From the Company: CEO Al Siblani tells RapidToday that flash curing is a breakthrough that combines the print speed of 3D printing with the accuracy of stereolithography or jetting. “You get highly accurate parts without sacrificing the speed,” he says.

What’s Next: “By the end of the year, we’ll be able to print a long-term temporary in 45 minutes [while the patient waits at the dentist’s office],” says Siblani.

imagen (an Ex One company)

Location: Pennsylvania, USA

Product: Digital Dental Printer

Launch: 2007

Cost: US$70,000-$110,000 for a printer, curing oven, furnace, and required tools; most labs lease the equipment, for a minimum of six months.

Capability: Only company that specializes in gold using spherical gold powder. Capable of building 200 copings per day.

Technology: Inkjet three dimensional printing process developed at MIT. Process is build, sinter, infiltrate.

Adoption: Commercially available for a year, imagen has sold thousands of units, according to General Manager Jeffrey McDaniel.

From the Company: “There are about 50 million porcelain fused to metal restorations required in North America every year. It’s a very large market,” says McDaniel. “We believe we are just scratching the surface in this area. The future is looking very positive and bright.”

What’s Next: Printing of full-span bridges is “very likely” later this year, says McDaniel.

EOS GmbH Electro Optical Systems

Location: Germany

Product: EOSINT M270

Launch: 2006

Cost: US$550,000

Capability: Manufacture customized crowns and bridge frameworks using a biocompatible cobalt-chrome (CoCr) alloy (inCorisNP) that was developed especially for dental implants. Capacity is 250mm x 250mm x 215mm, with a 20 micrometer layer thickness. Build speed is three minutes per crown. The slight roughness of the sintered parts aids in the adhesion of the ceramic coat.

Technology: Direct metal laser sintering (DMLS) fuses powdered metal with a laser beam.

Adoption: Used by 3M and Sirona Dental (for its infiniDent product) in Europe, but has little dental presence in North America.

From the Company: For the four years that EOS has been in the U.S., it has sold 30 metal sintering and 30 plastic sintering systems – 40 percent for aerospace, 40 percent for medical (cutting guides, spinal implants, custom stainless instruments), and 20 percent other. “Dental is a very small part of the [North American] business today, but we are looking to grow this important market,” says North America VP Jim Fendrick.

What’s Next: The company is developing a materials partner. EOS’s Chromium cobalt is popular in Europe but not the U.S. Noble and high noble alloys (gold, platinum, & palladium) are the majority of the North American market, but EOS doesn’t run these. “We are working on an agreement,” says Fendrick. “There is not anything that is technically impossible – it’s just a commercial issue.”

Want to comment on this article? Visit our additive fabrication forum.

Want to read more? Visit our additive fabrication archive.

Originally published: June 2008